POS vs Payment Processor: Which is Right for Your Business?

A point of sale (POS) system and a payment processor play distinct yet complementary roles in managing transactions.

While a POS system tracks sales and manages inventory, a payment processor handles transactions between the customer and the merchant.

Understanding the differences and how these systems integrate can help streamline operations and enhance customer experience.

In fact, businesses using integrated solutions report up to 25% higher efficiency in transaction management.

So, let’s dive into the details of each, compare their features, and determine which solution best fits your business needs.

Key Takeaways

- POS systems manage sales, inventory, and customer interactions.

- Payment processors handle the technical aspects of transaction processing.

- POS and payment processors can be used together for efficiency.

- Evaluate costs, features, and business needs when choosing between them.

- Partner with DBS for personalized POS system recommendations.

What Is a Point of Sale System?

A POS system is a comprehensive solution that facilitates the process of selling goods and services.

It integrates hardware and software to manage transactions, track sales, and monitor inventory in real time.

It includes components such as a cash register, barcode scanner, receipt printer, and POS terminal.

Modern POS systems are often cloud-based, offering enhanced functionality like real-time data access, remote management, and advanced reporting features.

Their main function is to streamline business operations by automating many tasks traditionally handled manually, such as calculating totals, processing payments, and updating inventory levels.

They also provide valuable insights through sales reports and analytics, helping businesses make informed decisions about stock levels and sales strategies.

For example, businesses using a POS system can track sales trends and inventory turnover, leading to more effective inventory management and improved customer service.

Some recommended POS systems are Revel Systems for general businesses, SpotOn POS for restaurants, and ECRS Catapult for retail stores.

Types of POS Systems

- Traditional POS Systems: These systems are hardware-based and include components like cash drawers, receipt printers, and barcode scanners. They are often used in retail and hospitality settings requiring physical registers and dedicated terminals.

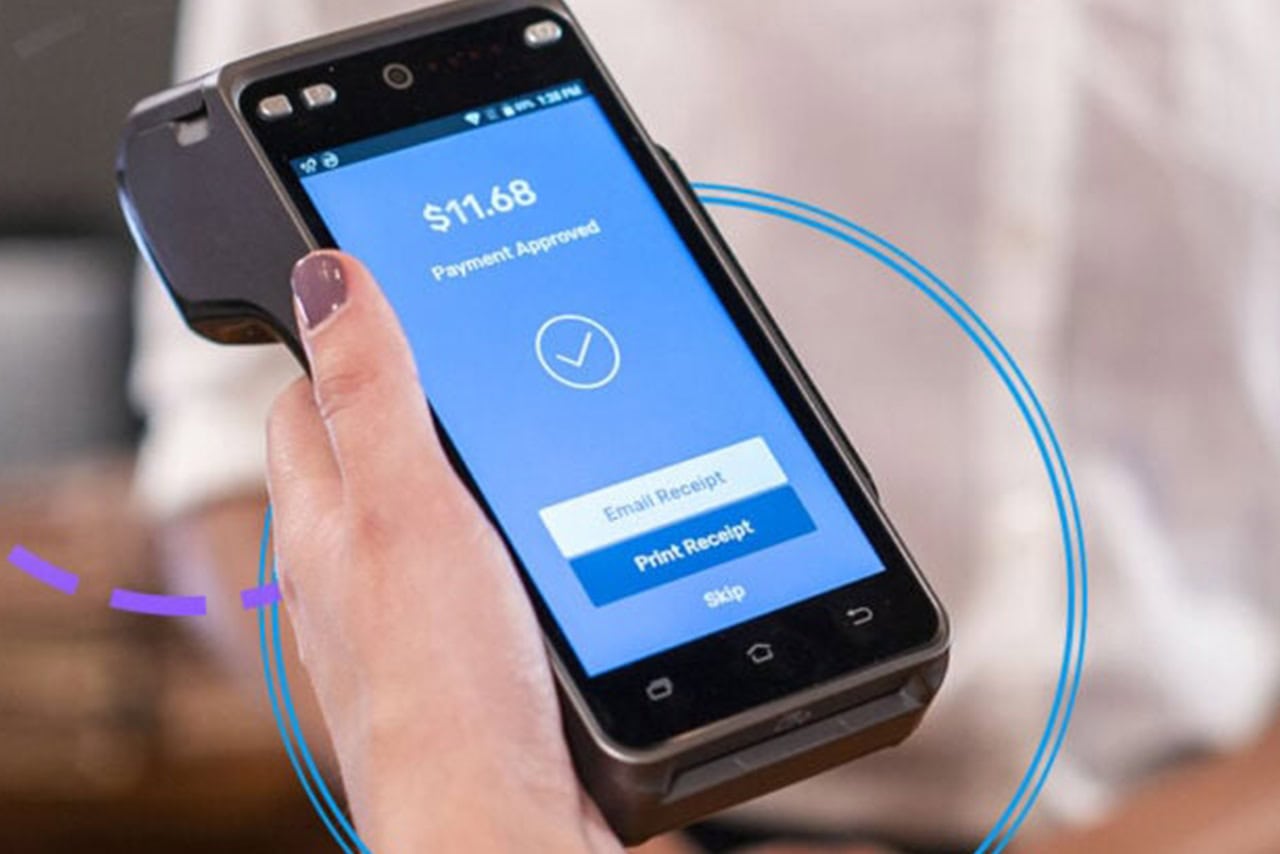

- Mobile POS Systems: Mobile POS (mPOS) systems use tablets or smartphones to process transactions. They are highly portable and ideal for businesses that require flexibility, such as food trucks or pop-up shops.

- Cloud-Based POS Systems: These systems store data online, allowing for real-time updates and access from any device with internet connectivity. They offer features like remote management and automatic updates, making them suitable for businesses with multiple locations or those that require frequent updates.

- Self-Service POS Systems: Commonly found in retail environments, these systems allow customers to complete transactions independently using touchscreen kiosks. They can speed up the checkout process and reduce labor costs.

Pros and Cons of POS Systems

Pros:

- Efficiency: POS systems streamline transaction processes, reducing checkout times and minimizing human error.

- Inventory Management: They offer real-time tracking of stock levels and automatic updates, helping businesses manage inventory more effectively.

- Data Insights: Advanced reporting features provide valuable insights into sales trends, customer behavior, and overall business performance.

- Customer Experience: POS systems can enhance customer service with features like quick transactions, loyalty programs, and personalized promotions.

Cons:

- Cost: Initial setup and ongoing maintenance costs can be significant, especially for high-end or custom solutions.

- Complexity: Some POS systems may have a steep learning curve or require extensive training for staff to use effectively.

- Dependence on Technology: Technical issues or system outages can disrupt business operations and impact sales.

- Integration Challenges: Integrating POS systems with other business tools or legacy systems can sometimes be complex and costly.

What Is a Payment Processor?

A payment processor is a service or a company that manages the transactions between a customer and a merchant.

When a customer makes a payment using a credit or debit card, the payment processor facilitates the communication between the merchant, the customer’s bank (issuing bank), and the merchant’s bank (acquiring bank).

The payment processor ensures that the payment information is securely transmitted, authorized, and settled.

Payment processors handle electronic payments, including online transactions, in-person payments, and mobile payments.

They are responsible for tasks such as encrypting payment data, routing transactions to the appropriate financial institutions, and managing transaction fees.

Payment processors are essential for businesses looking to accept credit and debit card payments, streamline payment operations, and provide a seamless customer experience.

How Payment Processors Work

- Transaction Initiation: The process begins when a customer swipes or enters their credit or debit card information to make a payment. Online payments involve entering card details into a payment gateway.

- Data Encryption: The payment processor encrypts the customer’s payment data to protect it from unauthorized access during transmission.

- Authorization Request: The encrypted payment data is sent to the payment processor, which forwards it to the customer’s issuing bank to request authorization for the transaction.

- Authorization Response: The issuing bank verifies the payment information and responds with an authorization code or denial. This response is sent back to the merchant through the payment processor.

- Transaction Completion: If authorized, the payment processor communicates with the merchant’s bank to complete the transaction. The funds are then transferred from the customer’s bank account to the merchant’s account, minus any processing fees.

- Settlement: The payment processor settles the transaction by transferring funds from the acquiring bank to the merchant’s account within a few business days.

Types of Payment Processors

- Full-Service Payment Processors: These providers offer a complete suite of services, including payment processing, merchant accounts, and support. Examples include Square and PayPal. They are ideal for businesses looking for an all-in-one solution.

- Payment Service Providers (PSPs): PSPs offer aggregated services, allowing businesses to process payments without setting up a separate merchant account. They often include features like fraud prevention and multiple payment options. Examples are Stripe and Adyen.

- Payment Gateways: These are specialized tools that facilitate online payments by securely transmitting payment information between the customer and the merchant’s payment processor. Examples include Authorize.Net and Braintree.

- Merchant Account Providers: These processors focus on providing merchant accounts necessary for accepting credit card payments. They often work in conjunction with the online payment gateway to process transactions. Examples are Worldpay and First Data.

- Mobile Payment Processors: These processors are designed specifically for mobile transactions, allowing businesses to accept payments via smartphones or tablets. Examples include Square and PayPal Here.

Pros and Cons of Payment Processors

Pros:

- Convenience: Payment processors enable businesses to accept various forms of payments, including credit and debit cards, online transactions, and mobile payments.

- Security: They employ advanced encryption and fraud prevention measures to protect sensitive payment data and reduce the risk of fraudulent transactions.

- Speed: Facilitate quick and efficient transaction processing, often providing real-time authorization and settlement.

- Integration: Many payment processors offer integration with other business tools, such as accounting software and POS systems, to streamline operations.

Cons:

- Fees: Charge transaction fees, monthly fees, and setup fees, which can add up, especially for small businesses.

- Complexity: The setup and management of payment processing systems can be complex, requiring technical knowledge or dedicated staff.

- Service Limitations: Some may have transaction types, processing volumes, or geographical coverage limitations.

- Risk of Disputes: May handle chargebacks and disputes, which can result in additional fees and administrative work for businesses.

POS vs Payment Processor: Key Differences

Functionality

- POS Systems: Primarily designed to manage transactions, track sales, and handle inventory. They offer features like sales reporting, employee management, and customer relationship management (CRM). POS systems provide a comprehensive solution for managing in-store operations and customer interactions.

- Payment Processors: Focus on facilitating the transaction between the customer and the merchant. Their primary function is to process payments and securely handle communication between financial institutions. They do not manage sales tracking or inventory.

Scope of Use

- POS Systems: Used for a wide range of business functions beyond payment processing, including inventory management, employee scheduling, and customer loyalty programs. Suitable for retail stores, restaurants, and other businesses requiring detailed transaction management.

- Payment Processors: Primarily used for processing payments. They are essential for businesses that need to accept electronic payments but do not necessarily require extensive sales management features. It is ideal for e-commerce sites, mobile vendors, and companies seeking simple payment acceptance solutions.

Integration

- POS Systems: Often integrate with other business tools like accounting software, CRM systems, and inventory management platforms. This integration allows for seamless data sharing and operational efficiency.

- Payment Processors: Can integrate with POS systems, online payment gateways, and other financial tools. However, their primary role is to work with payment-related functions, and they may not offer the same level of integration with broader business operations.

User Interaction

- POS Systems: Designed with user interfaces that cater to both employees and customers. Employees interact with the system to complete transactions, manage inventory, and generate reports, while customers interact with checkout interfaces or self-service kiosks.

- Payment Processors: Involve minimal user interaction beyond the payment itself. Customers enter payment information, while merchants manage transactions through a dashboard or backend interface.

Hardware

- POS Systems: Include a range of hardware components such as cash registers, barcode scanners, receipt printers, and card readers. The hardware setup is often tailored to the specific needs of the business.

- Payment Processors: These may require card readers or terminals but generally do not include extensive hardware. The hardware needs are usually limited to devices for accepting payments, such as POS terminals or mobile card readers.

Cost Structure

- POS Systems: Involve upfront hardware and software costs, ongoing maintenance, and support fees. Some systems may also have monthly subscription fees. Costs vary depending on the features and complexity of the system.

- Payment Processors: Charge per transaction fees, monthly fees, and sometimes setup fees. The cost structure focuses more on transaction volumes and may include fees for additional services such as chargebacks or fraud protection.

Customization

- POS Systems: Offer extensive customization options to tailor the system to specific business needs. This can include customizing the interface, adding features, and integrating with other software solutions.

- Payment Processors: Customization is generally limited to payment-related features, such as setting up payment options or integrating with existing systems. The focus is on adapting the payment processing to the merchant’s requirements rather than customizing broader business functions.

Can You Use Both?

Yes, you can use both a POS system and a payment processor together to maximize efficiency and functionality.

Integrating a POS system with a payment processor combines the comprehensive management of sales, inventory, and customer data with the seamless processing of payments.

This integration ensures that transactions are processed smoothly and sales data is automatically updated in real-time.

Both allow businesses to streamline operations, reduce manual entry errors, and provide a more cohesive customer experience.

FAQs

Is a POS the same as a payment processor?

No, a POS system and a payment processor are not the same. A POS system manages sales transactions, tracks inventory, and handles other business operations. On the other hand, a payment processor explicitly handles the transaction process between the customer and the merchant, facilitating payment authorization and fund transfers.

What is the difference between a processor and a payment service provider?

A payment processor handles the technical aspects of payment transactions, such as authorizing credit and debit card payments and transferring funds between banks. A payment service provider (PSP) offers a broader range of services, including payment processing, payment gateways, and additional features like fraud prevention and multi-currency support.

Conclusion

So which is which when it comes to POS vs payment processor? Each plays a unique role in your business operations. POS systems offer comprehensive sales and inventory management, while payment processors handle the transaction process.

Understanding these differences helps you choose the right solution for your needs. And yes, you can use both for optimal efficiency.

For personalized guidance and to explore how a POS system can benefit your business, schedule a demo with us at DBS. We’re here to help you make the right choice.